Could Labour spark a 'pharmacy exodus’ with capital gains tax hike?

In Business news

Follow this topic

Bookmark

Record learning outcomes

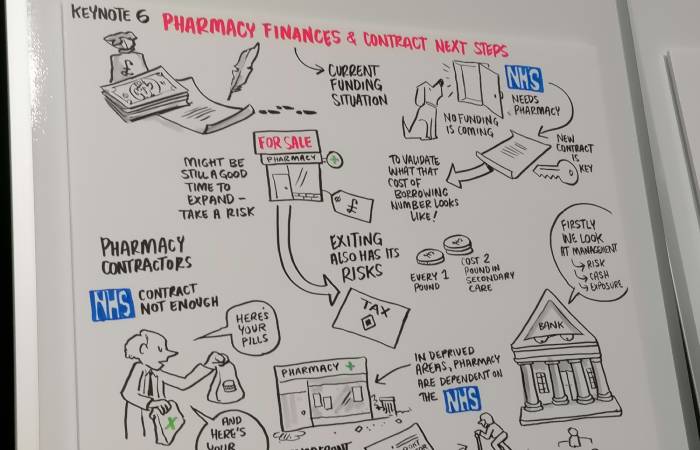

A rumoured move by Labour to increase Capital Gains Tax to as high as 39 per cent was discussed at the Pharmacy Show yesterday, with a Santander spokesperson urging contractors to consider wider factors before making a panic-driven sale.

In a session on pharmacy finances in the keynote theatre, Santander medical division head Andrew Casey was asked if we can expect to see an “exodus of pharmacies” if chancellor Rachel Reeves moves to hike the asset tax as rumoured in the national media.

“A change in tax tends to drive flurry of activity to try to then dispose of [the asset] before the new tax comes in,” said Mr Casey, adding that others choose to “sit on” the asset as a future change in government could see taxes lowered.

“For me I think when it’s right to go you look at the time, you look at the position, you make a decision as to whether you want to exit or not.

“Tax plays a part; don’t think it should be the overarching decision as to whether you buy or you necessarily sell.

“I look around, a lot of pharmacy is family owned and family-oriented, more than some of the other sectors I cover in the healthcare space.

“I’m not a tax expert, but I’ve not seen an increase in the number of pharmacies coming to market as a result of change in tax.

“It’s more because of the margin depression and people really beginning to struggle to operate and maintain reasonable margin.”

Day Lewis executive director Sam Patel said exiting a pharmacy can be “very expensive” because of factors like long leases and bank loans, adding that business owners may also have “emotional connections” and “people they’re looking after”.

“There are a lot of factors that go into considering leaving pharmacy,” said Mr Patel.

Asked what banks consider when pharmacies come to them for investment, Mr Casey replied: “We look at a number of things. People think we probably just look at the P&L balance sheet and cash flow, but the reality is that’s probably the last thing we look at.

“The numbers are driven by the management team, so the first thing we look at is whether this is a management team we want to support and believe in.”

Mr Casey said pharmacies are “really suffering” due to NHS funding cuts, adding that even had other costs like staffing stood still over the last few years, the sector still would have been hit by rising interest rates: “The cost of borrowing money has gone from zero to five per cent.”

A new contractual settlement will be “critical” in influencing banks’ willingness to lend to the community pharmacy sector, he said.